Life Insurance in and around Many

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

It can be what keeps you going every day to take care of your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that your partner can pay for college and/or keep paying for your home as they face the grief and pain of your loss.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Life Insurance You Can Trust

Some of your options with State Farm include coverage for a specific time frame or coverage for a specific number of years. But these options aren't the only reason to choose State Farm. Agent Buddy Wood's wonderful customer service is what makes Buddy Wood a great asset in helping you select the right policy.

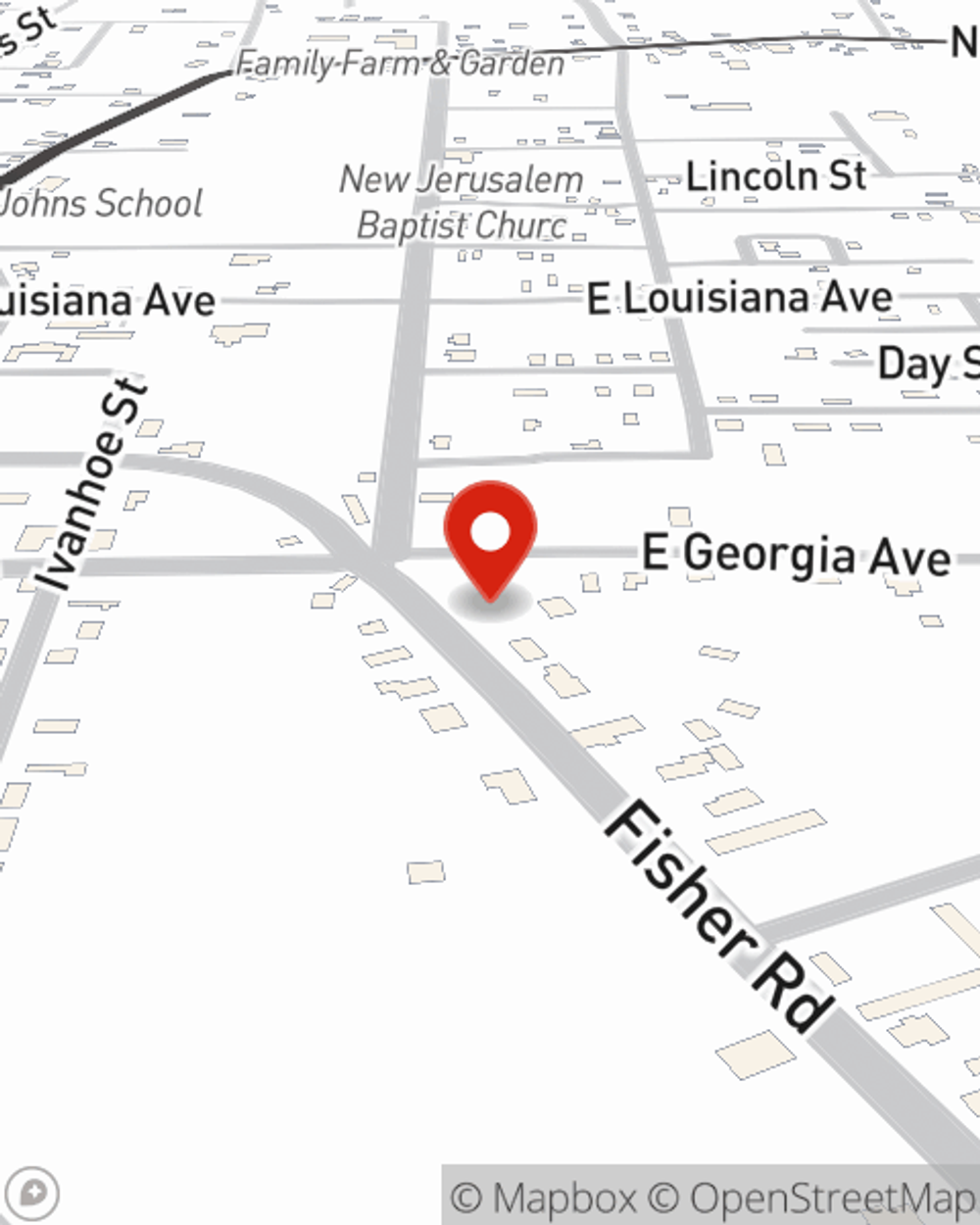

Simply talk to State Farm agent Buddy Wood's office today to experience how a State Farm policy can help protect your loved ones.

Have More Questions About Life Insurance?

Call Buddy at (318) 256-6201 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Is term life insurance right for your family?

Is term life insurance right for your family?

Term life insurance policies offer easy, affordable coverage for families and other people seeking life insurance protection for a specific period of time.